How top car brands are changing their marketing plans in the face of a downturn

New car sales have been in decline for the past five months in the face of unprecedented supply chain problems. In July, new registrations fell 9% from a year earlier and, coupled with the economic slump, car sales are now at their lowest levels in almost 30 years. Without stock to sell, car marketers have been forced to shift their strategies – and that means new demands have been put on their agencies.

Suzuki’s first brand campaign in five years

Automotive marketing has always been a reliable staple of traditional agency business. But seismic changes in the car industry have meant the agencies servicing the biggest car brands are being asked to approach marketing briefs in new ways to move the focus in ads away from simply buying a new model.

“There has been a big shift in automotive marketing departments from communications first to brand experience first,” explains Will Lion, joint strategy officer at BBH.

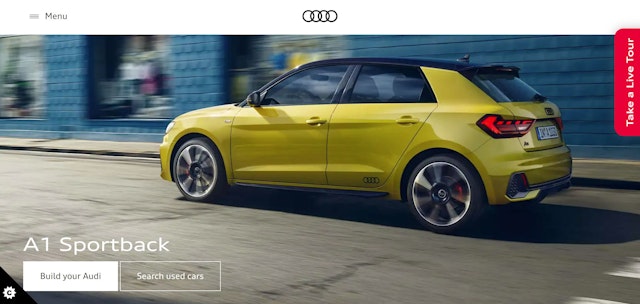

The agency counts Audi and Volkswagen among its biggest accounts. Lion says in the past year, the chief marketer’s focus has moved from product-first marketing pushes to upgrading the relationship with customers by talking about additional services. As such, marketers at the brands are asking the agency to think about how events and experiences can support the global strategy, rather than straight comms.

“[They’re] asking how we make the buying experience offline and online tighter so there is a digital physical blend,” he says.

This has meant a gradual shift in how the agency services these clients. The Audi account, for example, used to be “pointed squarely” at the creative department, but now it’s working much more with the customer experience (CX), user experience (UX) and digital teams, Lion says. BBH now runs Audi.co.uk, for example, and this has meant bringing talent with different skills into the agency to cater to the change in demand.

Keeping existing customers and prospects happy while they wait months, sometimes years, for their new car is the key challenge being presented to agencies right now.

Surprisingly, the supply crisis hasn’t yet hit manufacturers’ revenues. BMW, for example, jumped 12.1% in pre-tax revenue in Q1 2022 from $3.6bn to $12.8bn, and General Motors recently adjusted its full-year revenue from $9.6bn to $11.2bn. Analysts have been crediting the sale of luxury cars for helping boost revenue during the supply crisis.

Marius Bartsch, head of customer engagement at Digitas UK, says the smartest manufacturers are turning to data to understand things such as the lifestyle and life-stage of customers, and then using that information “to create programs to keep them interested until the next new model is available.” He advises car brands to double down on highly-profitable after-sales activity including extended warranties, servicing agreements and accessories in lieu of ATL campaigns.

Ford’s chief executive James Farley told analysts during its Q2 earnings update last month that it planned to simplify its marketing model to focus on that after-sales activity.

“We’re going to just shift ... all of our e-customers have a very predictable experience, whether they’re in a dealership or in their bunny slippers, and they’ll have a very simple, transparent, very easy purchase process. And we’re going to invest. Our marketing model is going to be post-purchase. That will be our differentiator, and that’s where we’ll invest.”

Audi, Volkswagen and Ford are not alone in directing focus to their digital operations in the face of this economic storm, and direct-to-consumer (DTC) sits at the heart of that.

Tesla is widely credited for kickstarting the DTC trend in the sector, but fellow car companies have been trying to change their business models to sell direct (rather than third-party) for some time. BMW started its journey as long ago as 2016, but DTC still hasn’t fully taken off. For some car brands, this pause in the market means they’ve been gifted time to really think about how to fuel that shift to DTC, and some have tasked their agencies with supporting more on that journey.

Amanda Phillips is regional client lead in Europe for Ford at VMLY&R. “The switch to DTC requires automotive manufacturers to re-focus their sites to a commerce model, pulling on new skills and capabilities internally, with their agencies and from tech suppliers,” she explains.

Phillips says consumers now expect the experience of buying a car to be the same as buying technology, and for the car itself to be an extension of our tech and our lifestyle. For example, some car companies have been integrating Apple Car Play, and Aston Martin built the Car Configurator app, which lets users pick specs and models.

This requires manufacturers to think more about end-to-end CX and own more of that experience. “As a result, their business model is shifting, paving the way for new specialist suppliers to add into their mix,” Phillips adds.

As a result, both Lion and Phillips say advertising budgets aren’t changing, but shifting into digital, and experiential is changing the media mix from traditional creative.

Brand marketing

Some brands have been focused on repositioning their brand strategy to get them through this period. Lion explains that for the past few years Volkswagen has been pivoting its commercial business, but the supply issues have “put rocket boosters” on that strategy. “We [Volkswagen/BBH] are using that downtime where we can’t be aggressively selling because there is nothing to sell to reorientate the brand in a different direction,” he says – for example, trying to reposition its modern-day campervan as an everyday use car.

Aston Martin also recently rebranded, tweaking its logo and updating its tone of voice, and Suzuki rolled out its first brand campaign in five years with the wacky ‘Good different’ TV spot.

Alex Key, senior marketing communications manager at Suzuki, who led the campaign, says the intention of the ad “isn’t to get someone to walk into a dealership tomorrow. The fact that the stock isn’t there doesn’t really matter, the play is much bigger.” Brand ideas take time to enter the public consciousness, so Key is hoping “the effect will start to matter when we come out of the chip shortages.”

Suzuki was keen not to wait till the supply problems eased, otherwise it “risked” being another two years behind. “The longer you aren’t in the market, the harder it is to get back,” Key says.

Working with Iris, Suzuki wanted to reassert its ‘quirky but good quirky’ brand ethos. “The acid test for this campaign is if this starts to feel like everything else then we’ve failed – we have 2% market share, nobody is thinking about us,” Key says. “The job is that we have to be the wildcard fourth choice on someone’s shortlist, and that requires disruptive advertising.”

Emma Harris, chief executive officer of brand agency Glow London, concludes that the performance of the car and the price bracket are no longer the only decision-making factors when buying a car. “Today, when car manufacturers/OEMs are delivering similar quality, choosing a car is increasingly based on the consumer’s every interaction with the brand,” she says.

Brands need to upgrade everything from advertising and customer service, to call centers and dealerships, digital experiences and peer recommendations, Harris says. “Ultimately, car brands need to be creating brand salience right along the entire customer journey to drive growth, retention and loyalty.”