Why Amazon has a ‘struggle’ on its hands if it is to rival TikTok’s live shopping

Social shopping is heating up, but can “utilitarian” Amazon wrestle back control of the shop window from TikTok?

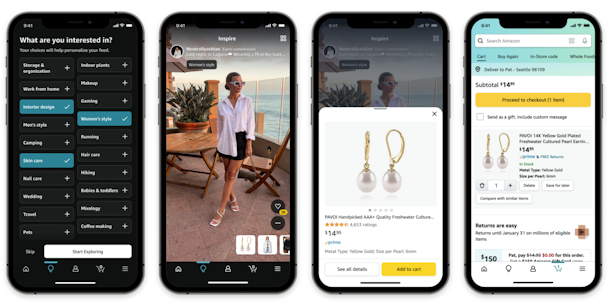

Inspire feed on Amazon app / Amazon

Last month, Amazon launched Inspire – a feed within its app that features photos and videos of items users can purchase from the retailer. The company also recruited influencers to create content for the feed and tied with brands to populate the stream.

In doing so, Amazon joined Walmart in the video commerce space, the American giant having first dipped its toes in these trendy waters in October when it added 32-second swipeable videos to its retail media offshoot, Walmart Connect. This TikTok-esque content allows customers to learn more, add to their basket and make a purchase, all without leaving the video.

Advertisement

Firework is one of the tech companies behind Walmart’s live shopping site. Its chief business officer, Jason Holland, tells The Drum that video commerce is far more effective than “traditional, static media“ when it comes to driving engagement, conversions and customer loyalty.

As for Amazon’s bet on livestream video, that, he says, is a “clear affirmation” of video’s role in the future of online shopping (even if he thinks it might have a bumpy ride ahead).

“Amazon faces some considerable challenges as it tries to force its way into the video commerce space. Whereas apps like TikTok and YouTube have struggled to convince American consumers to complete a transaction on their platforms, Amazon will struggle to convince users that content consumption has a place in what is a very utilitarian customer journey.”

Paul Kasamias, the managing partner of performance at Publicis-owned Starcom, meanwhile calls the move an “incredibly interesting pivot”. He says Amazon has long been a “notoriously” transactional platform, with a preference for customers to buy in as few clicks as possible, whereas Inspire is more of an “entertainment-based destination and a large pivot into the new world of influencers and socializing commerce”.

Advertisement

Video commerce is booming

Social shopping is thriving, estimated to have been worth $992bn globally in 2022 and projected to grow to $2.9tn by 2026. The Asia-Pacific region is significantly further ahead of the west, with social commerce there contributing an estimated $42bn to Southeast Asia’s e-commerce market in 2022.

While there is much money up for grabs for retailers in this booming market, social platforms have virtually complete control over video commerce. The move by Amazon and Walmart is born out of a need to circumvent the walled gardens and own the complete purchase journey of a social shopping transaction.

Suggested newsletters for you

Retailers running video commerce sites is not a new concept. Alibaba launched its livestream shopping service Taobao Live in 2019, amassing $61bn gross merchandise value in its first year.

The case of Amazon and Walmart, says Kasamias, is a vote of confidence for other performance brands to “TikTok-ify their owned offering”.

According to research by eMarketer, users are spending up to 46 minutes a day on TikTok, while The Social Element puts monthly usership in the UK at 27 hours.

“By replicating the TikTok stream model, Walmart and Amazon are hoping to make their content a video consumption/entertainment destination that both occupies attention and also drives conversions,” adds Kasamias.

Tamara Littleton, the chief executive officer at The Social Element, says that this trend isn’t about replicating or “shunning” TikTok, but instead is driven by a need to move the “shop window from TikTok back into the retailer’s control”.

For brands that follow suit, Littleton urges they maintain their presence on TikTok: “If Amazon and Walmart were to feel that their investment in a TikTok-style shoppable experience is an alternative to TikTok itself, they would be greatly miscalculating.”

Littleton says the benefit to brands of using TikTok and other social platforms isn’t the purchasing of products, but rather the community. “Engagement and shared collective experiences that social media fosters are really powerful tools to build greater long-term brand value that can convert to sales.”