Google and Amazon fight it out for retail ad spend

A recent report from eMarketer on digital ad spending reveals that paid search is now the fastest-growing ad format in retail and eCommerce. The report says retail advertisers in the US alone will spend $13.12bn on search in 2019, a 22.5% increase from last year - and this will reach $15.65bn in 2020.

Vertical Leap consider the trends in retail and eCommerce.

Retailers aren’t simply increasing paid search ad spend, though. While Google Ads budgets are increasing steadily (mostly thanks to shopping campaigns), the dramatic rise of spending on Amazon search ads marks the beginning of a new battle in retail digital advertising.

Amazon overtakes Google for product searches

Last year, Jumpsot.com released its 2018 Q2 competitive eCommerce report, revealing that Amazon has surpassed Google in the total number of product searches. The report attributes 54% share of product searches to Amazon vs 46% to Google - a complete reverse of the shares it published in 2015.

It makes sense that advertisers are shifting budgets over to the platform where a majority of product searches are taking place. However, search volumes alone don’t tell the whole story.

The same report shows that searchers on Amazon generally take longer (avg. 25.9 days) to make purchases than those on Google (avg. 19.6 days). For both networks, the majority of purchases are made within five days of the first search but the percentage of Google users buying in this time frame is significantly higher (35% vs 19%).

Retail advertisers need to understand how these differentiators are going to impact KPIs and potentially skew results over certain time frames - for example, total impressions and clicks vs conversion rates and return on ad spend.

It will be interesting to see how retail ad spend between Google and Amazon changes over the next few years but Google is clearly facing competition.

The race for retail ad spend is on

While Amazon has been steadily building its retail empire, Google has been doing everything it can to establish its search engine into a consumer platform. The search giant has identified retail as the key area for future growth and Amazon as its biggest competitor in this field.

Last year, AI search intelligence platform Adthena released a report analyzing 40 million search ads from more than 260,000 retailers. The report revealed that, as of Q1 2018, retail brands in the UK were spending 82% of their Google Ads budgets on Product Listing Ads, accounting for 87.9% of all clicks from paid search.

Aside from generating higher click-through rates (CTRs) for retail searches, PLAs are widely reported to have significantly lower costs-per-click (CPCs) as well - at a time when text ad CPCs are on the rise.

eMarketer’s 2019 digital ad spending report also points towards Google’s integration of product ads into other services - notably Google Maps. Brands can pay for promoted pins to appear in the app and supplement this with product ads once users click on the pins.

“It’s become more common for retailers to link search ads into Google Maps, which helps drive traffic into stores and show local stock of a specific product,” eMarketer said of its report.

This is an area where Amazon doesn’t really compete, using ads to drive local in-store visits. At least, for now anyway.

This raises an important point: Google and Amazon aren’t like-for-like platforms. One is primarily a search engine whereas the other one is an eCommerce marketplace. Amazon is where people go when they know they want to buy something but Google has a much broader use case.

People turn to the search engine when they need help with making buying decisions (product guides, best of [product type], reviews, etc.), which can be nurtured with tools like remarketing. With Google Ads, you can also target users who have made non-eCommerce purchases with offers for products that might be of interest - eg: summer clothes for people who have just booked a holiday.

It’s important to understand the different capabilities of each platform when dividing your ad spend.

There’s one area where Google and Amazon have a lot in common, though.

Monetising voice search

With Google Home and Amazon Echo devices becoming a growing presence in homes across the country, the real fight between these two tech giants is monetising voice search.

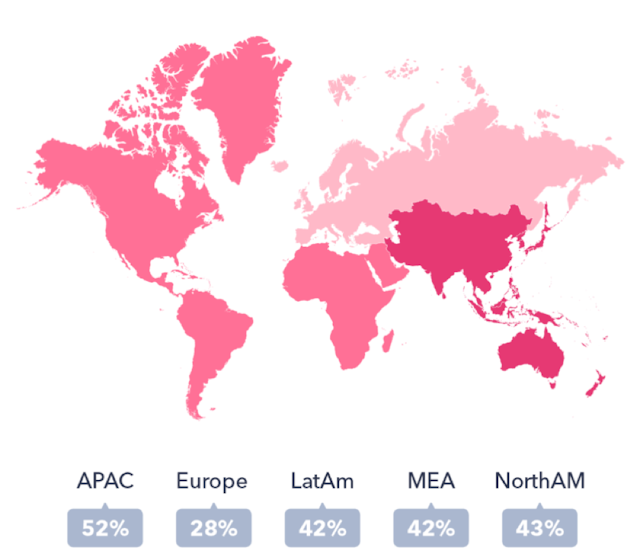

According to data from Global Web Index, Europe is a little behind voice adoption than other regions so it might help to look at US data to see where we’re headed. Last year, a study carried out by Voicebot.ai (PDF) asked US consumers about their voice shopping habits.

The key findings:

- 1 in 5 consumers have bought via search

- 31.72% of those have bought something new (not a repeat purchase)

- Household items and clothing are the most common purchases

- Consumers like the hands-free experience

- Security concerns and a lack of screen are barriers to adoption

While voice purchases are on the up, there’s clearly a long way to go before the technology becomes widely adopted as a shopping channel, let alone a monetised channel where advertisers can promote their products.

Google and Amazon face all the same challenges in terms of monetising voice search and this could be where the battle for top retail advertiser is decided.

Michelle Hill, Marketing manager at Vertical Leap.

Content by The Drum Network member:

Vertical Leap

We are an evidence-led search marketing agency that helps brands get found online, drive qualified traffic to their websites and increase conversions/sales.

To...