As m-commerce takes the world contactless, should agencies follow suit?

Contactless and other mobile-based digital fintech payment methods surged in popularity during the pandemic and will remain in use afterwards. But are there risks to businesses and consumers? For our deep dive into all things Mobile, columnist Samuel Scott looks into the issue.

What will be the implications of new payment systems for consumers and merchants?

My stepfather still writes checks rather than use debit cards, even though he holds up store lines and annoys everyone. Why? He says it prevents careless overspending. And he represents both an opportunity and a problem for mobile payment apps today.

The rise of mobile and other fintech payment apps

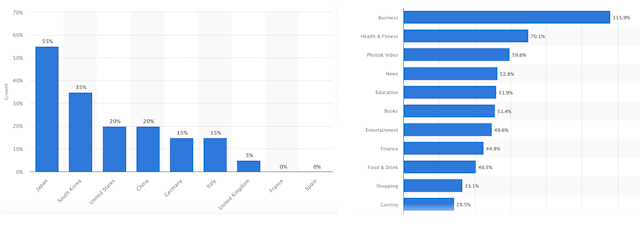

According to information compiled by Statista, weekly usage of finance-related mobile apps increased 20% in the US, 20% in China and 5% in the UK after the coronavirus pandemic had begun (see the left-hand graphic). Total business-related spending on mobile apps rose by 116% in Europe during all of 2020 (see the right-hand image).

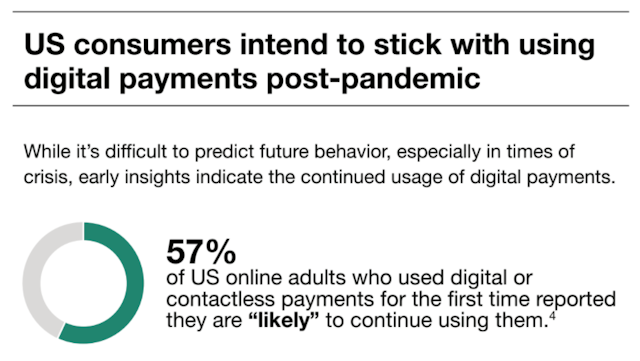

Moreover, 11% of online adults in the US used a digital payment for the first time as the coronavirus pandemic was growing in April 2020, according to a Forrester Research report. 19% did so in May 2020 – and 62% of those were made using mobile phones rather than ‘contactless’ credit cards.

“The pandemic was like a fault line that caused a seismic shift in digital payment behaviors,” Lily Varon, a senior analyst at Forrester, tells me. “US consumers historically are very stubborn in our payment habits, but the desire to avoid touching cash and payment terminals were incentive enough to combat our collective inertia.”

According to the Forrester report, 57% of surveyed US online adults who used digital or contactless payments for the first time said they were ‘likely’ to continue using them.

“We’ve finally reached critical mass adoption in digital payments in the US as a result of the pandemic, but digital payments have been gaining ground over other payment methods like direct card usage for a few years,” Varon adds.

“Early indicators [today] point to some of these new payment behaviors sticking around: about half of those US shoppers using their credit cards in stores have recently used them to make a contactless payment – as in during early 2021.”

What will be the implications of this new payment system for consumers and merchants? For that, we need to look at history.

The history

Human beings and businesses used only hard coins and paper notes as payment methods until the use of checks in Europe starting in the 18th century. Charge cards, which relied on merchant fees and where balances had to be paid in full each month, appeared in the US in the early 20th century.

Bank of America issued the first credit card with revolving credit lines and finance charges in 1958. That year, the financial institution introduced the product with the famous ‘Fresno Drop’ and mailed 60,000 new credit cards with limits of up to $500 to people in the California city – along with running accompanying local ad campaigns.

What happened? On the consumer side, many people thought of the card as ‘free money’ – repayment delinquencies were 22% rather than the projected 4%. Fraud was commonplace. On the merchant side, businesses were not happy paying a 6% processing fee to the bank.

Every financial evolution leads to societal change – for better and worse. Credit cards eventually did become commonplace and have allowed people to purchase and possess expensive household amenities immediately instead of waiting until they had saved enough money to pay in lump sums.

But as the Fresno Drop predicted, the trade-off has been that some consumers use credit irresponsibly and that all businesses – including ad agencies and martech platforms – need to protect themselves against potential fraud and other misuse.

The same is true for the mobile-based fintech and other alternative payment methods that arose just before and during the coronavirus pandemic today.

The bad side for consumers

When I once worked for a marketing agency that focused on B2B high-tech clients, the chief executive told everyone to highlight to them that our work “shortens sales cycles”. His theory was that getting a company to purchase a $1m platform traditionally takes more time than convincing a person to buy a $1 chocolate bar.

In a similar way, every new financial system has shortened payment cycles. From checks to charge cards to credit cards to payment apps, every so-called ‘cashless’ advancement merely helps consumers to part with their money more and more quickly and easily.

In the early 2010s, I had a roommate who became addicted to reality TV cooking shows. For $1.99 per episode, he would push a button, pay the charge and download or watch one after another on some platform all night, every night – and he never thought about how much he was spending (I just hope he never discovered The Great British Bake Off).

As most debt advisors will tell people, it is the small, routine and barely noticeable spends that add up and are the most dangerous. A $4 cup of premium coffee here. A $2 sausage roll there. A $10 membership to One True Voice’s fan club. Payment apps make it much easier to buy stuff without a second thought.

A 2000 study by the Massachusetts Institute of Technology found that people spend more when they use credit cards instead of cash. A 2017 one by University of Toronto professor Avni Shah found that paying by smartphone was even worse.

“You don’t really think about the outflow of money when you use a phone,” Shah tells Consumer Reports. “It represents a social device, not a payment.”

In the UK, there is also controversy over the buy-now-pay-later app Klarna. The company says it is better than credit cards because it does not charge interest or late fees. But the consumer organisation Citizens Advice has warned that the platform can be a ”slippery slope into debt”.

But for consumers, another problem is security. “Payment apps and services are intended for transactions between friends and others you trust,” Ed Mierzwinski, senior director of the Federal Consumer Program for the US Public Interest Research Group (US PIRG), tells me.

“The money leaves your account almost instantly and transactions are generally not reversible. It’s easy to send money to the wrong person by mistake. It’s easy for scammers to trick you into sending money to them.”

US PIRG was scheduled to release a new report today on how digital payment apps can reportedly harm consumers. The study examines such complaints to the US Consumer Financial Protection Bureau.

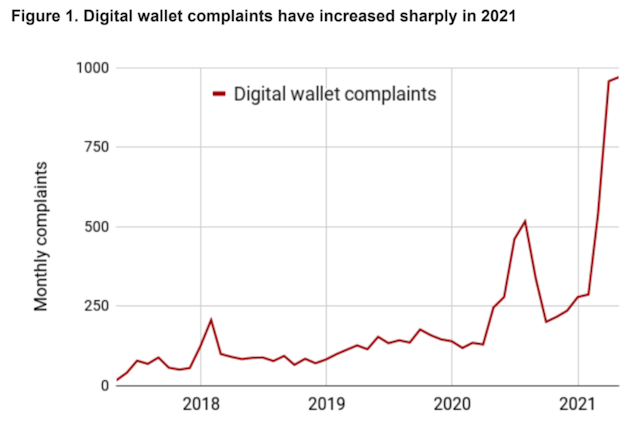

“In April 2021, there were 970 digital wallet complaints – almost double the previous complaint peak in July 2020,” the report states. The three most common complaints were problems managing, opening or closing accounts; fraud or scams; and issues with unauthorized and other transactions.

“Consumers should only use payment apps and services for transactions between friends,” Mierzwinski adds.

“Even then, before sending money, ask your friend to send you a request for the money to make sure you have the right username. Consumers should link their app to either a credit card or a separate small checking account, not to their primary account or one with a sizable balance. Immediately file complaints about fraud with your app, your bank and the CFPB.”

The threat to merchants

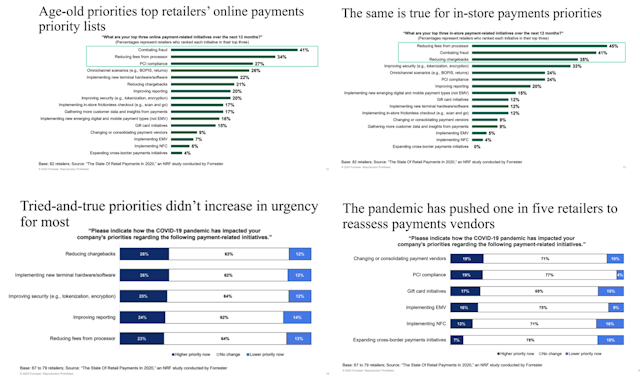

A related Forrester report found that merchants have the same top two concerns for both online payments and in-store digital payments: combating fraud and reducing processing fees.

The good news is that apps such as Apple Pay and Google Pay in the US do not charge additional fees – in contrast to banks and other digital platforms such as PayPal. They are merely go-betweens for merchants between the credit cards and the payment. Only the standard credit card processing fees usually apply.

In the UK, card payments on the Monzo app in the country and abroad are free. Revolut, in a different example, is more of a full banking app rather than just a simple payment app and charges £6.99 a month.

But security is also an issue for merchants. “A scammer could buy something from you, appear to send a payment but cancel it,” Mierzwinski says.

“Further, consumer protections that apply to consumer transactions generally do not protect business accounts. Businesses should also read the terms of service carefully as some payment services cannot be used for business purposes. Some payment services may have separate business accounts.”

Regardless, Varon tells me that businesses are now incorporating such payment technologies into their permanent strategies because “no one wants to relegate them to passing Covid-19 coping mechanisms”.

“Contactless payments acceptance will be a permanent fixture in the vast majority of retail stores soon, but we can also expect to see some of the retail leaders – those who were ahead of the game in terms of curbside pick-up and other omnichannel commerce initiatives – begin to expand their digital and mobile payments acceptance across more channels and scenarios,” she says.

How agencies can use payment apps

During the worst of the coronavirus pandemic, I hired The Hive Studio, a creative agency here in Tel Aviv, to create a 60-second highlight reel cut from footage from some of my prior speaking engagements. After they finished their excellent work, I sent the payment through Bit – the major local fintech payment app – with 10 taps of my finger on my phone.

The benefit to me? Bit is connected to a charge card that gets airline points – and there are no fees. I use it as much as possible. Plus I avoid the hassle of logging on to my bank’s website and doing tedious transfers. And checks – seriously? Literally the only person to whom I still write checks is my landlord, and I think that is because it is required by Israeli law.

And the benefit to The Hive Studio? They get the funds on Bit immediately and can pay others with that money or withdraw the amount to a bank account. Most importantly, the commonly used Israeli business accounting platforms approved by the finance ministry and tax authority all recognize and incorporate the use of such payment apps.

“Using Bit simplifies the way payments work,” Amit Gicelter, the agency’s chief executive, tells me. “It allows me to track my payments via the app and local invoice software and easily pay for purchases on the go.”

While it is impossible to know how many ad agencies or martech platforms are now processing payments through mobile fintech apps, another told me that they are using alternative platforms.

“Our ideal as a company is to go cashless,” Jenny Quigley-Jones, founder of the YouTube creator agency Digital Voices in London, says.

“All international creators we work with on campaigns are paid via Veem – an alternative to traditional bank payments. We recently introduced Pleo cards for staff expenses, where everyone can also automate expense reports digitally. Bi-weekly we treat everyone to a company paid lunch, and we use Deliveroo’s app rather than having employees expense meals back.

“Being cashless allows an extra element of trackability and accountability for spending. More fundamentally, we’re excited by a cashless society as the future is e-commerce, which allows brands and marketers to know more about their customers, products and what works for campaigns.”

The future of mobile payment apps

The old joke is that there are only two things certain in life: death and taxes. Well, I would add a third: business regulation. Whenever a new technology platform becomes popular, governments – for better or worse – will seek to monitor it (just see social media).

In Israel, transfers through Bit accounts are limited to NIS 3,600 ($1,100) per day. I would not be surprised if there will be more rules here and in the US and UK as well – for the benefit of both consumers and businesses.

Mierzwinski tells me that he recommends that government policymakers ensure that consumers are protected when they are defrauded into sending money – even when the consumer ‘initiated the payment’ – and that app providers are required to investigate errors and fraud even when the consumer made the mistake or sent the money.

“This is an existing duty not being enforced,” he says. In the meantime, I do not expect my stepfather to use mobile payment apps any time soon.

The Promotion Fix is an exclusive column for The Drum contributed by global keynote and virtual marketing speaker Samuel Scott, a former journalist, newspaper editor and director of marketing in the high-tech industry. Follow him on Twitter. Scott is based out of Tel Aviv, Israel.